What Is Zaggle?

Zaggle provides world-class financial solutions and products to automate and innovate workflows for managing business expenses for corporates, SMEs, and startups. It is located in Hyderabad, and operates where SaaS meets Fintech. It is listed in the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) under the name ZAGGLE (BSE Code: 543985). The company is categorized in the Information Technology sector and Software Services sub-sector and Zaggle Share Price is best for long term Profit Growth.

Company History — Milestone Timeline

On June 2, 2011, Zaggle Prepaid Ocean Services Private Limited was founded as a private limited company in Hyderabad. Then, on August 22, 2022, the company changed to a public limited company, and a new certificate of incorporation was issued on September 13, 2022, changing the name to Zaggle Prepaid Ocean Services Limited.

Zaggle launched Zoyer, an integrated data driven business, and Zakey, a contactless payment device, in 2022. In September 2023, the company completed its Initial Public Offering with 34,352,255 equity shares worth ₹563.37 crore. This includes a fresh issue of 23,902,439 equity shares worth ₹392 crore and 10,449,255 equity shares worth ₹171.37 crore under an Offer for Sale. In 2023 the company also launched a spend analytics platform named Zatix.

In December 2025, Zaggle’s board approved its first acquisition, marking a significant strategic move. Specifically, the company decided to acquire Rivpe Technology, a fintech firm offering UPI payment services and co-branded consumer credit cards, for up to ₹22 crore, along with an additional investment of ₹75 crore.

In December 2025, the board also sanctioned the establishment of a wholly-owned subsidiary at GIFT City, Gujarat, which will be called Zaggle Payments IFSC. This will facilitate Zaggle’s foray into international financial services.

Zaggle’s latest acquisition was with Rio Money on July 29, 2025.

Business Model

Zaggle is a B2B, B2C, Fintech, SaaS Company, and a foremost player in spend management, with a unique value proposition and a diversified user base. The company stands among the limited fintech firms serving both businesses and end users through a diverse portfolio of technology-driven financial solutions. In partnership with leading banks, it has also emerged as one of India’s major issuers of prepaid cards. In addition, it has a diversified range of Software as a Service, including tax and payroll software, and has a vast touchpoint reach.

Core Products and Services

Zaggle’s primary offerings include Propel, a SaaS platform for channel partner reward and incentive programs and employee recognition and rewards; SAVE, a SaaS-based employee expense management, reimbursement, and benefits platform; and Zoyer, a data-driven integrated SaaS platform for procure-to-pay and utility payments.

- Zaggle designed the Payroll Card as a prepaid payroll card to manage the salary disbursement and employee financial benefits process electronically.

- CEMS (Customer Engagement Management System) is a system that allows merchants to manage customer experiences comprehensively, including rewarding customers through gift cards and loyalty programs.

- Zatix is an analytics engine that uses artificial intelligence. They bought it in FY2025 and it will change the way businesses make financial decisions.

- ZIP (Zaggle International Payments) – At GIFT City and with some new forex innovations, Zaggle has made its first mark in Global Financial Solutions. It has also onboarded WSFX as a strategic referral partner for Forex Cards in cross-border payment solutions.

- Global Fintech Fest 2025 launched Zaggle GlobalPay as one of its new products. Global Fintech Fest 2025 also witnessed the launch of another new product.

- Zakey is a contactless payment wristwatch that was launched in 2022.

- Zaggle has recently partnered with some businesses and won contracts.

- Hindware has signed a 3-year contract with Zaggle for its Propel rewards platform. Rebel Foods has won a 1-year contract with Zaggle to use the Zaggle Zoyer platform. HDFC ERGO General Insurance has entered into a three-year partnership with Zaggle to utilize its Propel rewards platform for employee and customer engagement services. Euronet India has collaborated with Zaggle to launch co-branded prepaid cards designed for corporate clients, enhancing digital payment and expense management solutions.

- Zaggle has also signed a 5-year contract with Mastercard for Mastercard credit cards and solutions, with Zaggle getting more spend-linked rewards. It has partnered with travel management companies Hummingbird, FCM, and TBO Paxes to provide AI-Driven spend management solutions to improve travel and corporate travel management.

Financial Performance — Latest Numbers

Zaggle disclosed Q3 FY2025 outcomes on February 12, 2026. Standa lone revenue surged to ₹5,061.3 million with net profit at ₹359.7 million. Consolidated revenue touched ₹5,342.1 million with net profit at ₹370.6 million.

Zaggle Prepaid Ocean Services’ net profit increased 72.45% compared to the same period last year to ₹34.99 crore in Q2 FY2025-2026. When looking at quarterly growth, the firm achieved a 34.01% increase in net profits in the last 3 months.

EPS (Earnings Per Share): ₹6.99 for financial year 2024-25. EPS for Q2 FY2025: ₹2.61. Employees: 422. Revenue for the last 12 months (up to June 2025): $163 million (about ₹1,363 crore).

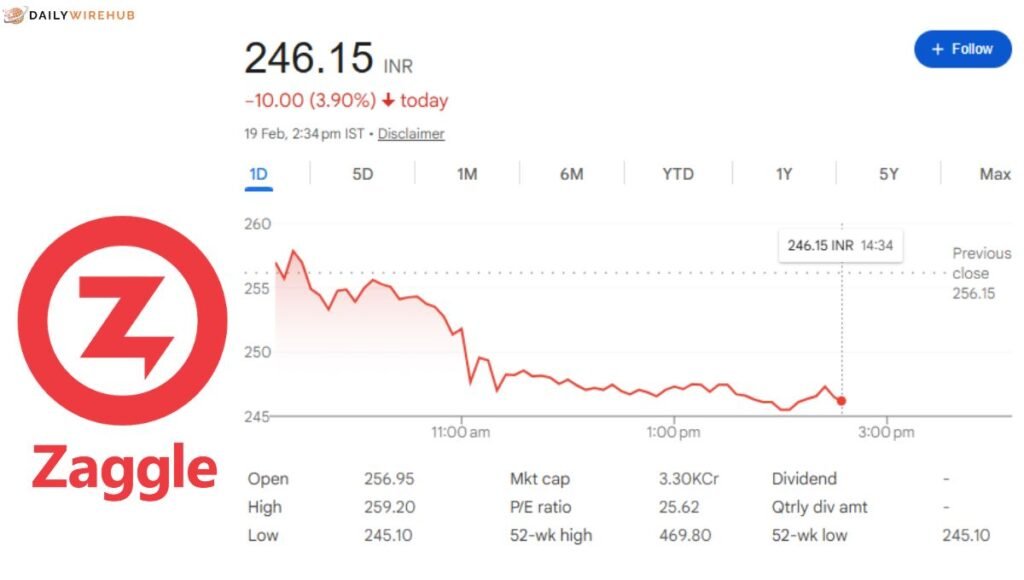

Analysis of Share Price – Major Developments

ZAGGLE share price on January 14, 2026, stood at ₹302.50. On the same date, the market cap of Zaggle Prepaid Ocean Services is ₹4,114.90 crore. Over the last 52 weeks, the Zaggle Share Price has peaked at ₹547.10 and dropped to ₹298.65 The current P/E ratio is 46.80 and P/B ratio is 3.29. Tickertape

| Detail | Fact |

| NSE Ticker | ZAGGLE |

| BSE Code | 543985 |

| IPO Price (Sept 2023) | ₹164 per share |

| 52-Week High | ₹591.90 |

| 52-Week Low | ₹298.65 |

| Present Market Cap | ₹3,671 crores (Source: Screener, Feb 2026) |

| Book Value / Share | ₹97.37 |

| Price to Book Ratio (P/B) | 3.46 |

| Delivery Percentage | 55.40% |

The firm is almost debt-free and has demonstrated a commitment to reducing debt. Yet, she has a deterioration in return on equity of 12.4% over the last 3 years.

Valuation

The EPS of Zaggle Prepaid Ocean Services Limited is 8.28, making it of inexpensive merit in the realm of profit and revenue margins. The book value/share is ₹97.37 and current P/B ratio is 3.46 and the current date is January 2026. When it comes to current stock price, valuation of ZAGGLE stock current levels is considered to be overpriced. Stocks-buy

An investor at the IPO price of ₹164 in September 2023, the investor would have realized a gain of over 260% by the 52-week high of ₹591.90. The market has drastically corrected the stock and expects it to trade within a range of ₹300-370 at the end of 2025 and early 2026.

Future Predictions – Stock Price Targets

| Year | Lower Range (₹) | Upper Range (₹) |

| 2025 | ₹313.10 | ₹450.60 |

| 2026 | ₹450.60 | ₹588.60 |

If the company manages to expand internationally through GIFT City and ZIP, as well as deepen its enterprise customer base via Propel and Zoyer, and maintains its quarterly profit growth streak of 34%+, Zaggle may reach ₹600 to ₹700 by 2027. However, investors should consider the valuation and the other operating expenses as a sustainability risk, and these factors are extremely important.

Risk Factors

A P/E ratio of 46 appears relatively high given the company’s current growth phase. 12.4% return on equity is well below the industry standard for a rapidly growing SaaS company and is only for 3 years. The company shares are currently trading close to the 52-week lowest value which is a sign of a larger concern from investors. An increase in retail investor holdings, coupled with stagnant institutional investors and promoters, is a bearish indicator. Competition from overseas spend management companies, especially with the likes of Ramp, Brex, Happay and WEX, is growing stronger.

| Detail | Fact |

| Company Name | Zaggle Prepaid Ocean Services Limited |

| NSE Ticker | ZAGGLE |

| BSE Code | 543985 |

| Founded | June 2, 2011 |

| Headquarters | Hyderabad, Telangana |

| Employees | 422 |

| IPO Date | September 2023 |

| IPO Price | ₹164 per share |

| Current Zaggle Share Price (Feb 2026) | ₹247.10 |

| 52-Week High | ₹591.90 |

| 52-Week Low | ₹298.65 |

| Market Cap (Jan 2026) | ₹4,114.90 crore |

| Market Cap (Feb 2026) | ₹3,671 crore |

| 2025 Price Target | ₹313 (Downside) → ₹450 (Upside) |

| 2026 Price Target | ₹450 (Downside) → ₹588 (Upside) |

| Key Products | Propel, SAVE, Zoyer, Zatix, ZIP, Zakey |

| Major Clients | HDFC ERGO, Rebel Foods, Hindware, Mastercard |

Conclusion

Zaggle Prepaid Ocean Services Limited is an example of a genuine high-growth B2B, B2C, fintech, SaaS company, having developed an impressive range of products covering spend management, employee rewards, prepaid cards, and cross border international payments. Since its inception in 2011, and having gone public on NSE and BSE in September 2023 at an IPO price of ₹164, the share price climbed to a 52-week zenith of ₹591.90, subsequently stabilizing to the vicinity of ₹300 in early 2026. For Q3 FY2026, a net profit of 72.45% year-on-year was recorded. The company is devoid of debt, and owing to the increasing number of enterprise connections with HDFC ERGO, Rebel Foods, Hindware, and Mastercard, alongside international growth via GIFT City and Zaggle Payments IFSC, the foundation of the company is solid. The 2026 Zaggle Share Price targets range from ₹450 to ₹589.

For long-term investors prepared to navigate the volatility of the fintech sector and tolerate high P/E valuations, Zaggle stands out as one of India’s most distinctive SaaS–fintech hybrid companies.

Disclaimer: This is an article showcasing information and is not to be considered financial advice. Always consult with a financial advisor registered with SEBI before taking any decisions related to investments.

Read More:

Vikran Engineering Share Price: IPO, Share Price Targets 2026–2030, and More